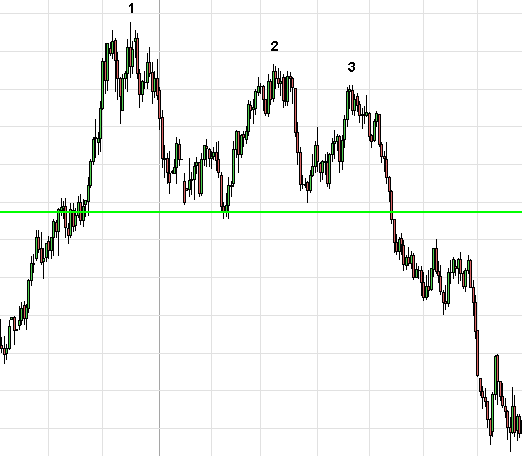

There are three equal highs followed by a break below support. The triple candlestick reversal patterns Morning Star.

In this article we look at the structure of the triple bottom chart pattern what the market tells us through this formation.

/dotdash_Final_Triple_Top_Dec_2020-01-78a37beca8574d169c2cccd1fc18279d.jpg)

. Inverted Head and Shoulders. It has a bullish version and a bearish version which is the same as the bullish version except everything is upside down. C Three advancing white soldiers.

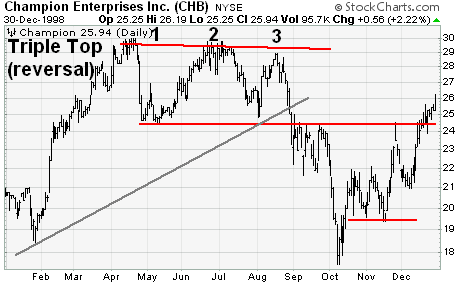

HEAD SHOULDERS gives traders a confirmation that a bearish reversal is about to take place. As opposed to the triple bottom it appears at the end of an uptrend suggesting a likelihood of trend change. It signals the slowing down of upward momentum before a bearish move lays the foundation for a new downtrend.

The Evening Star pattern is a three-candle bearish reversal candlestick formation that appears at the top of an uptrend. The triple bullish candlestick patterns are formed by three candlesticks. Secondly the triple top requires a minimum of five to six candles to create.

Candlestick dapat digunakan bersamaan dengan alat analisa teknikal lainnya. On the other hand the evening star is created after an uptrend not in a sideways range. Morning Star and Evening Star.

The double top pattern is a chart pattern that occurs when the price moves in a similar pattern to the letter M. Just the opposite of the morning star the evening star pattern. It is said that the analysis of this triple candlestick pattern is more accurate and is more often used by traders to read trends.

Lower prices may be on the way. Made up of three peaks a triple top indicates that the asset may no longer be coming up. Another triple candlestick pattern you might notice is called the three white soldiers pattern.

The three line strike candlestick pattern is a 4-candle pattern. Well in this pattern a Doji will appear in the middle. What Candlestick Pattern is show below.

This is a potent pattern which usually takes place after a long downtrend and a period of consolidation. This means that price is trading sideways as each of the three tops is formed. Like Doji the spinning top is a candlestick with a short body.

A Morning star candlestick pattern. Note that a Triple Top Reversal on a bar or line chart is completely different from Triple Top Breakout on a PF chart. The triple top chart pattern forms after a sustained rally.

Generally they are bullish reversal patterns. Para trader pasti sudah sangat mengetahui bahwa jenis pola candlestick yang banyak dipakai oleh para trader karena akurasinya lebih tinggi yaitu pola candlestick triple. Both the Morning Star and Evening Star patterns comprise a combination of three candlesticks but they signal opposite directional movement in a currency pair.

This takes place when three long bullish candles develop. This pattern also indicates indecision and may suggest a period of rest or consolidation after a significant rally or price decline. This chart pattern can be present on all time frames.

If you understand the double pattern lets discuss the triple pattern. The triple top is used in technical analysis to determine the reversal in the movement of the price of an asset. They are of four main types.

The triple top is a bearish chart pattern that tests the high of a price three times before the price falls and breaks to new lows. Similar to the double bottom and double top these triple stick candlestick patterns consist of more than three candles but theres three major areas you should look out for. Double top analysis is used in technical analysis to explain how prices move in a security or other investment and can be used as part of a trading strategy to exploit recurring patterns.

It usually happens following a downtrend meaning that a reversal pattern is taking place. Occurring at the end of a downward move. Dalam analisa teknikal penggunaan pola candlestick bisa dijadikan sebagai alat konfirmasi yang digunakan bersama-sama dengan beberapa indikator.

Pola ini sebenarnya tidak jauh berbeda dengan double top. Its a chart on Tesla starting around the 19th October. A bullish three line strike has 4 candles.

B Bullish abandoned baby. Evening Star And Morning Star. The bearish two black gapping continuation pattern appears after a.

Ini dikarenakan candlestick menggunakan opening high low dan closing price sama seperti bar chart. A triple bottom pattern is made up of many candlesticks that make three support levels or valleys that are either of equal or near-equal height. Triple top is an important pattern.

You can see that because we hit the bottom 3 times at roughly the same price. When the third valley forms it is unable to hold support above the first two valleys and results in a triple bottom breakout. When you see a Morning Star pattern you should consider it to be a bullish signal.

The morning star pattern occurs after a downward price move. Statistics show unusual accuracy for the buy and sell signals of certain candlestick patterns. D Three inside up.

As major reversal patterns these patterns usually form over a 3 to 6 month period. The triple bottom is a bullish reversal pattern that occurs at the end of a downtrendThis candlestick pattern suggests an impending change in the trend direction after the sellers failed to break the support in three consecutive attempts. Sesuai dengan tema maka pada pembahasan kita kali ini kita akan bahas dan menjelaskan pola triple top dalam trading forex.

These patterns are bullish reversals created in bearish trends. First the triple top pattern takes place in a sideways range. Reliable Triple Candlestick Pattern 1.

The Triple Top Reversal is a bearish reversal pattern typically found on bar charts line charts and candlestick charts. However the two shadows are of equal length leaving the body right in the middle.

Chart Patterns Triple Tops Triple Bottoms

:max_bytes(150000):strip_icc()/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-01-4e2b46a5ae584c4d952333d64508e2fa.jpg)

Technical Analysis Triple Tops And Bottoms

Trading The Double Top And Triple Top Reversal Chart Patterns

The Complete Guide To Triple Top Chart Pattern

:max_bytes(150000):strip_icc()/dotdash_Final_Triple_Top_Dec_2020-02-f2c3428399574d4181d943daf126cf77.jpg)

0 comments

Post a Comment